Corporate Information

Included in this 2020 Annual Review are financial and operating highlights and summary financial statements. For complete financial statements, including notes, please refer to Centene’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the Securities and Exchange Commission (the “2020 Form 10-K”), which also includes Management’s Discussion and Analysis of Financial Condition and Results of Operations. This 2020 Annual Review, together with our 2020 Form 10-K, constitute our annual report to security holders for purposes of Rule 14a-3(b) of the Securities Exchange Act of 1934, as amended. Our 2020 Form 10-K may be obtained by accessing the investor section of our company’s website at www.centene.com or by going to the SEC’s website at www.sec.gov.

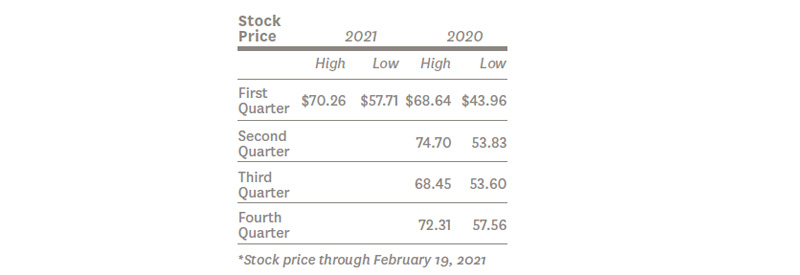

Common Stock Information

Centene common stock is traded and quoted on the New York Stock Exchange under the symbol "CNC."

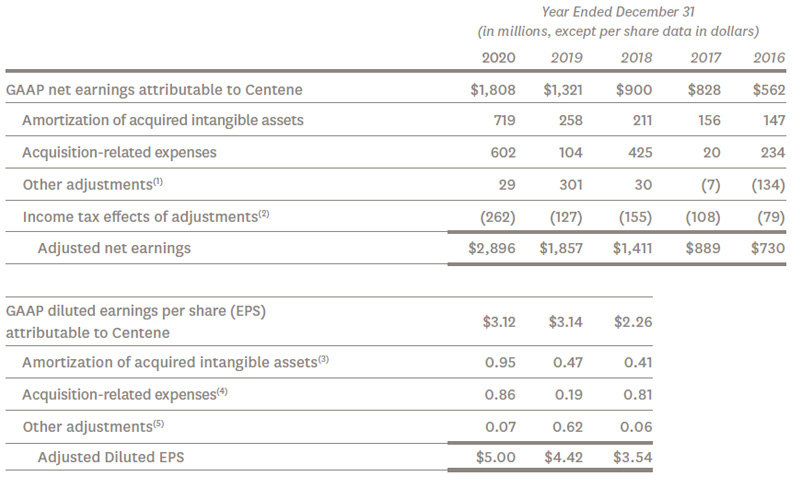

NON-GAAP FINANCIAL RECONCILIATIONS

(1) Other adjustments include divestiture gain of $104 million, or $0.10 per diluted share for the year ended December 31, 2020; non-cash impairment of $72 million, or $0.10 per diluted share for the year ended December 31, 2020; debt extinguishment costs of $17 million and $30 million, or $0.02 and $0.05 per diluted share for the three months ended December 31, 2020 and 2019, respectively, and $61 million and $30 million, or $0.07 and $0.05 per diluted share for the year ended December 31, 2020, and 2019, respectively; and noncash goodwill and intangible asset impairment of $271 million, or $0.57 per diluted share, for the year ended December 31, 2019.

(2) The income tax effects of adjustments are based on the effective income tax rates applicable to each adjustment.

(3) The amortization of acquired intangible assets per diluted share presented above is net of an income tax benefit of $0.08 and $0.04 for the three months ended December 31, 2020, and 2019, respectively, and $0.29 and $0.14 for the year ended December 31, 2020, and 2019, respectively; and an estimated $0.31 for the year ended December 31, 2021.

(4) The acquisition related expenses per diluted share presented above are net of an income tax benefit of $0.05 and $0.02 for the three months ended December 31, 2020, and 2019, respectively, and $0.18 and $0.06 for the year ended December 31, 2020, and 2019, respectively; and an estimated $0.08 to $0.10 for the year ended December 31, 2021.

(5) Other adjustments include the following items: gain related to the divestiture of certain products of the Company's Illinois health plan of $0.10 per diluted share, net of income tax expense of $0.08 for the year ended December 31, 2020; noncash impairment of our third party care management software system of $0.10 per diluted share, net of an income tax benefit of $0.02 for the year ended December 31, 2020; debt extinguishment costs of $0.02 and $0.05 per diluted share, net of an income tax benefit of $0.01 and $0.02 for the three months ended December 31, 2020, and 2019, respectively, and $0.07 and $0.05 per diluted share, net of an income tax benefit of $0.04 and $0.02 for the year ended December 31, 2020, and 2019, respectively; noncash impairment of $0.57 per diluted share, net of an income tax benefit of $0.08 for the year ended December 31, 2019; and restructuring costs of an estimated $0.08 to $0.10 per diluted share, net of an estimated income tax benefit of $0.03 for the year ended December 31, 2021.

NON-GAAP FINANCIAL PRESENTATION

The Company is providing certain non-GAAP financial measures in this report, as the Company believes that these figures are helpful in allowing investors to more accurately assess the ongoing nature of the Company’s operations and measure the Company’s performance more consistently across periods. The Company uses the presented non-GAAP financial measures internally to allow management to focus on period-to-period changes in the Company’s core business operations. Therefore, the Company believes that this information is meaningful in addition to the information contained in the GAAP presentation of financial information. The presentation of this additional non-GAAP financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. Specifically, the Company believes the presentation of non-GAAP financial information that excludes amortization of acquired intangible assets, acquisition-related expenses, and other items allows investors to develop a more meaningful understanding of the Company’s performance over time.

FORM 10-K

Centene has filed an Annual Report on Form 10-K for the year ended December 31, 2020, with the Securities and Exchange Commission. Stockholders may obtain a copy of this report, without charge, by writing:

Investor Relations

Centene Corporation

7700 Forsyth Boulevard

St. Louis, MO 63105

TRANSFER AGENT

Broadridge Corporate Issuer Solutions, Inc.

51 Mercedes Way

Edgewood, NY 11717

855-627-5087

https://shareholder.broadridge.com/bcis/

ANNUAL MEETING

The Annual Meeting of Stockholders was held in a virtual format at 10 a.m., Central Time, on Tuesday, April 27, 2021, at http://www.virtualshareholdermeeting.com/CNC2021.

CASH DIVIDEND POLICY

Centene has not paid any dividends on its common stock and expects that its earnings will continue to be retained for use in the operation and expansion of its business.

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

All statements, other than statements of current or historical fact, contained in this communication are forward-looking statements. Without limiting the foregoing, forward-looking statements often use words such as “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “seek,” “target,” “goal,” “may,” “will,” “would,” “could,” “should,” “can,” “continue” and other similar words or expressions (and the negative thereof). Centene (the “company”, “our”, or “we”) intends such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we are including this statement for purposes of complying with these safe-harbor provisions. In particular, these statements include, without limitation, statements about our future operating or financial performance, market opportunity, growth strategy, competition, expected activities in completed and future acquisitions, including statements about the impact of our proposed acquisition of Magellan Health (the Magellan Acquisition), our recently completed acquisition of WellCare Health Plans, Inc. (WellCare and such acquisition, the WellCare Acquisition), other recent and future acquisitions, investments and the adequacy of our available cash resources.

These forward-looking statements reflect our current views with respect to future events and are based on numerous assumptions and assessments made by us in light of our experience and perception of historical trends, current conditions, business strategies, operating environments, future developments and other factors we believe appropriate. By their nature, forward-looking statements involve known and unknown risks and uncertainties and are subject to change because they relate to events and depend on circumstances that will occur in the future, including economic, regulatory, competitive and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions. All forward-looking statements included in this communication are based on information available to us on the date hereof. Except as may be otherwise required by law, we undertake no obligation to update or revise the forward-looking statements included in this communication, whether as a result of new information, future events or otherwise, after the date hereof. You should not place undue reliance on any forward-looking statements, as actual results may differ materially from projections, estimates, or other forward-looking statements due to a variety of important factors, variables and events including, but not limited to: the impact of COVID-19 on global markets, economic conditions, the healthcare industry and our results of operations and the response by governments and other third parties; the risk that regulatory or other approvals required for the Magellan Acquisition may be delayed or not obtained or are obtained subject to conditions that are not anticipated that could require the exertion of management’s time and our resources or otherwise have an adverse effect on the company; the risk that Magellan Health's stockholders do not approve the definitive merger agreement; the possibility that certain conditions to the consummation of the Magellan Acquisition will not be satisfied or completed on a timely basis and accordingly the Magellan Acquisition may not be consummated on a timely basis or at all; uncertainty as to the expected financial performance of the combined company following completion of the Magellan Acquisition; the possibility that the expected synergies and value creation from the Magellan Acquisition or the WellCare Acquisition will not be realized, or will not be realized within the applicable expected time periods; the exertion of management’s time and our resources, and other expenses incurred and business changes required, in connection with complying with the undertakings in connection with any regulatory, governmental or third party consents or approvals for the Magellan Acquisition; the risk that unexpected costs will be incurred in connection with the completion and/or integration of the Magellan Acquisition or that the integration of Magellan Health will be more difficult or time consuming than expected; the risk that potential litigation in connection with the Magellan Acquisition may affect the timing or occurrence of the Magellan Acquisition or result in significant costs of defense, indemnification and liability; a downgrade of the credit rating of our indebtedness, which could give rise to an obligation to redeem existing indebtedness; the possibility that competing offers will be made to acquire Magellan Health; the inability to retain key personnel; disruption from the announcement, pendency and/or completion and/or integration of the Magellan Acquisition or the integration of the WellCare Acquisition, or similar risks from other acquisitions we may announce or complete from time to time, including potential adverse reactions or changes to business relationships with customers, employees, suppliers or regulators, making it more difficult to maintain business and operational relationships; our ability to accurately predict and effectively manage health benefits and other operating expenses and reserves, including fluctuations in medical utilization rates due to the impact of COVID-19; competition; membership and revenue declines or unexpected trends; changes in healthcare practices, new technologies, and advances in medicine; increased healthcare costs; changes in economic, political or market conditions; changes in federal or state laws or regulations, including changes with respect to income tax reform or government healthcare programs as well as changes with respect to the Patient Protection and Affordable Care Act (aca) and the Health Care and Education Affordability Reconciliation Act, collectively referred to as the ACA and any regulations enacted thereunder that may result from changing political conditions, the new administration or judicial actions, including the ultimate outcome in “Texas v. United States of America” regarding the constitutionality of the ACA; rate cuts or other payment reductions or delays by governmental payors and other risks and uncertainties affecting our government businesses; our ability to adequately price products; tax matters; disasters or major epidemics; changes in expected contract start dates; provider, state, federal, foreign and other contract changes and timing of regulatory approval of contracts; the expiration, suspension, or termination of our contracts with federal or state governments (including, but not limited to, Medicaid, Medicare, TRICARE, or other customers); the difficulty of predicting the timing or outcome of pending or future legal and regulatory proceedings or government investigations; challenges to our contract awards; cyber-attacks or other privacy or data security incidents; the possibility that the expected synergies and value creation from acquired businesses, including businesses we may acquire in the future, will not be realized, or will not be realized within the expected time period; the exertion of management’s time and our resources, and other expenses incurred and business changes required in connection with complying with the undertakings in connection with any regulatory, governmental or third party consents or approvals for acquisitions; disruption caused by significant completed and pending acquisitions making it more difficult to maintain business and operational relationships; the risk that unexpected costs will be incurred in connection with the completion and/or integration of acquisition transactions; changes in expected closing dates, estimated purchase price and accretion for acquisitions; the risk that acquired businesses will not be integrated successfully; restrictions and limitations in connection with our indebtedness; our ability to maintain or achieve improvement in the Centers for Medicare and Medicaid Services (CMS) Star ratings and maintain or achieve improvement in other quality scores in each case that can impact revenue and future growth; availability of debt and equity financing, on terms that are favorable to us; inflation; foreign currency fluctuations; and risks and uncertainties discussed in the reports that Centene has filed with the Securities and Exchange Commission. This list of important factors is not intended to be exhaustive. We discuss certain of these matters more fully, as well as certain other factors that may affect our business operations, financial condition and results of operations, in our filings with the Securities and Exchange Commission (SEC), including our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Due to these important factors and risks, we cannot give assurances with respect to our future performance, including without limitation our ability to maintain adequate premium levels or our ability to control our future medical and selling, general and administrative costs.